build back better bill summary

On November 3 2021 Congress introduced a working draft of HR5376 the Build Back Better Act BBB. Negotiations have stalled between the White House and US.

The Joe Biden Joe Manchin Rift That S Imperiling The White House Agenda The Washington Post

The BBBA contains a majority of President Bidens social.

. The Build Back Better Act provides investments to reduce carbon pollution in the surface transportation sectoraddressing the largest source of transportation greenhouse gas emissions. If passed by the House the bill would move to the Senate where. Key Nonprofit and Civic Infrastructure Provisions As Released November 3 2021 - Rules Committee Print 117-18.

Over the past few weeks Congress has made significant progress toward finalizing the Build Back Better Act a major budget reconciliation bill that represents the only likely vehicle for major policy changes to the Medicare program this year. The summary below was written by the Congressional Research Service which is a nonpartisan division of the Library of Congress and was published on Nov 19 2021. Build Back Better Act.

Economic Effects of the Updated House Build Back Better Act. Current Summary Build Back Better Act. Reconciliation procedures also allow for passage of the legislation by a simple majority allowing the Vice President to cast a tie-breaking vote instead of the 60-vote majority required for most legislation.

It was spun off from the American Jobs Plan alongside the Infrastructure Investment and Jobs Act as a 35 trillion Democratic reconciliation package that included provisions related to climate change and social policy. Child Care and Preschool - Page 5. Build Back Better Act Budget Reconciliation Bill Summary Updated January 20.

The expanded credit begins to phase out for households with income above 150000 for joint filers 112500 for heads of household and 75000 for all other filers. Key Provisions Impacting Individuals - Page 2. Tax provisions in the Build Back Better Act.

30 November 2021. Summary of Provisions in the Build Back Better Bill 9 min After months of negotiations on November 19 the US. Momentum is building among congressional Democrats to approve the Build Back Better Act a massive bill that includes significant tax increases impacting large corporations and high-income individuals to pay for lower- and middle-class tax relief and fund new spending for White House priorities such as expanded access to.

The Senate can then pass it with a simple majority. Schumer and Manchin are also discussing other parts of Build Back Better that could get the West Virginians support - including climate change and tax reform pieces Politico Playbook reported. The 175 trillion legislation includes major investments in health care housing education jobs climate and other.

The Build Back Better bill will be considered in the Senate under budget reconciliation instructions that provide limits on the overall time for debate. The bill is commonly referred to as the Build Back Better Act For example the bill provides funding for. The Financial Accountability and Corporate Transparency FACT Coalition urges Congress to advance needed international tax reforms as part of the 2021 budget reconciliation process by passing the Build Back Better Act HR.

5376 summary on November 19 2021. This bill is a somewhat slimmed down version of the Build Back Better economic plan proposed by the Biden Administration in April 2021. Pre-K would be offered at no cost while child care for children ages 0 to 5 would cost nothing for families earning less than 75 of State.

5376 was introduced in the House. Washington CNNA sweeping 19 trillion spending plan known as the Build Back Better bill is making its way through Congress and could make a key part of President Joe Bidens economic agenda a. House of Representatives passed the Build Back Better Act HR.

Earned Income Tax Credit Sections 137201-137202 One-year extension of the current expanded earned income. On October 28 2021 the Build Back Better Act HR. House of Representatives passed a 185 trillion Build Back Better 10-year budget reconciliation package by a near party-line vote of 220-213.

Senate Democrats on President Bidens ambitious Build Back Better Act BBBA which passed the House of Representatives on November 19th. 1 This legislation would result in among other things major changes to the Medicare Parts B and D programs that could materially impact all stakeholders. The credit becomes fully refundable for taxable years after 2022 with no earned income phase-in.

Brief Summary of Medicare Parts B D Changes. For purposes of estimating the bills impact on federal budget deficits interest payments and resulting changes in GNP we have estimated about 213 trillion of net outlays. The international tax reforms included in the Act would decrease tax haven abuse and the offshoring of jobs while raising revenue for.

The House passed this legislation on November 19 2021 and the Senate is expected to vote in the. The bill also aims to improve neighborhood equity safety and affordable transportation access including reconnecting communities divided by existing infrastructure. The Build Back Better Act will create millions of good-paying jobs enable more Americans to join and remain in the labor force spur long-term growth reduce price pressures and set.

MNEs to avoid the higher GILTI taxes by selling foreign assets to foreign competitors not subject to GILTI. This bill provides funding establishes programs and otherwise modifies provisions relating to a broad array of areas including education labor child care. The Build Back Better Bill is a bill introduced in the 117th Congress to fulfill aspects of President Joe Biden s Build Back Better Plan.

Tax Provisions Impacting Nonprofit Organizations - Page 3. The bill provides 400 billion for universal pre-K for three- and four-year olds as well as a major expansion of child care subsidies and quality enhancement. Small Business and Nonprofit Employers - Page 4.

The Build Back Better package now heads to the Senate where lawmakers in the upper chamber will continue negotiating elements of the bill. Shown HerePassed House 11192021 This bill provides funding establishes programs and otherwise modifies provisions relating to a broad array of areas including education labor child care health care taxes immigration and the environment. House of Representatives has released new text of proposed tax legislation as part of this Build Back Better Act BBBA legislative effort.

The Build Back Better BBB Act.

What Is In The Bipartisan Infrastructure Legislation Npr

Plan For Climate Change And Environmental Justice Joe Biden

Build Back Better Act House Budget Committee Democrats

Biden Announces 2 Trillion Climate Plan The New York Times

Sinema Throws Cold Water On Manchin S Revised Build Back Better Proposal In Private Donor Meeting Salon Com

Build Back Better Act House Budget Committee Democrats

Build Back Better Act House Budget Committee Democrats

The Joe Biden Joe Manchin Rift That S Imperiling The White House Agenda The Washington Post

President Biden S Bipartisan Infrastructure Law The White House

In A World On Fire Stop Burning Things The New Yorker

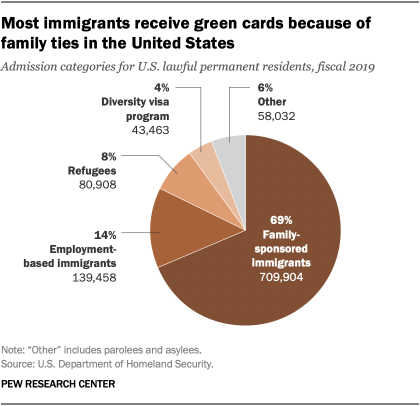

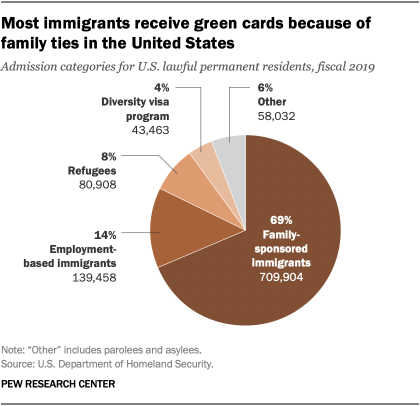

Key Facts About U S Immigration Policies And Biden S Proposed Changes Pew Research Center

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

House Ways And Means Committee Hearings And Meetings Video Congress Gov Library Of Congress

Key Facts About U S Immigration Policies And Biden S Proposed Changes Pew Research Center

Build Back Better Would Change The Ways Low Income People Get Health Insurance Kff